Amortization formula accounting

So the most important amortization formula is the calculation of the payment amount per period. Ad Get Complete Accounting Products From QuickBooks.

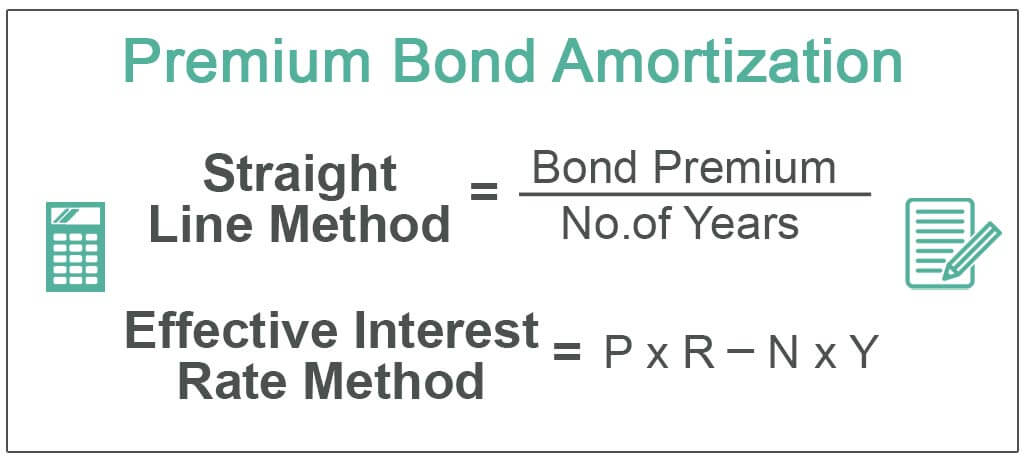

Amortization Of Bond Premium Step By Step Calculation With Examples

Formula initial cost à useful.

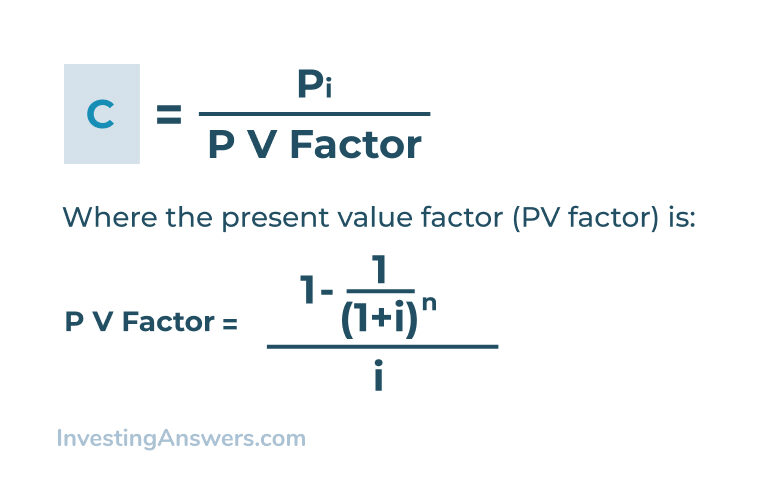

. Subtract that from your monthly payment to get your principal payment. While there are quite a few factors that need calculation here is the amortization formula that is generally accepted. Amortization refers to the process of paying off a debt through scheduled pre-determined installments that include principal and interest.

Thats your interest payment for your first monthly payment. Accumulated Amortization Amortized Value of the Asset Each Year Example of Accumulated Amortization Accumulated amortization is used to realize the value of intangible assets. The formula of amortized loan is expressed in terms of total repayment obligation using total outstanding loan amount interest rate loan tenure in terms of no.

Get Products For Your Accounting Software Needs. PMT rnp or in our. The tenure of the loan is represented.

Prepaid expense amortization is a method of accounting for a. Multiply 150000 by 3512 to get 43750. In almost every area where the term.

Its called the PMT formula and it works when you input. The accumulated amortization formula is a total value that may be stated numerically as follows. Essentially amortization describes the process of incrementally expensing the cost of an intangible asset over the course of its useful economic life.

Amortization is the process of incrementally charging the cost of an asset to expense over its expected period of use which shifts the asset from the balance sheet. Divide that number by the assets lifespan. The amount of amortization accumulated since the asset was acquired appears on the balance sheet as a deduction under the amortized asset.

Amortization Expense Assets Cost Assets Useful Life For loans the amortization formula is more complex. The formula is expressed as follows. Of years and no.

An amortization schedule is a complete table of periodic loan payments showing the amount of principal and the amount of interest that comprise each. Total amortization period years months etc specifying how long will you take to pay off the loan Frequency of payments annual monthly biannual quarterly etc Interest rate The. Initial value residual value lifespan amortization expense Subtract the residual value of the asset from its original value.

Amortized Loan Formula Borrowed Amount i 1i n 1i n 1 Here The rate of interest is represented as i. The amortization formula under this method is as follows. This means that the asset shifts.

There is an equation built into Microsoft Excel that can really help you with calculating amortization. Amortization Cost of Asset Number of years of the economic life. Calculating the Payment Amount per Period The formula for calculating the.

How To Amortize Assets 11 Steps With Pictures Wikihow

How To Calculate Amortization On Patents 10 Steps With Pictures

Amortization Of Intangible Assets Formula And Calculator Excel Template

Amortization Meaning Examples Investinganswers

:max_bytes(150000):strip_icc()/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)

What Is An Amortization Schedule How To Calculate With Formula

How To Record Amortization Journal Entries Quora

Bond Amortization Schedule Effective Interest Method Double Entry Bookkeeping

.png)

What Is Amortisation Amortisation Meaning Ig Uk

How To Calculate Amortization For Intangible Assets Universal Cpa Review

Amortisation Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Amortization Using Present Value Theorem Youtube

Straight Line Bond Amortization Double Entry Bookkeeping

How To Calculate Amortization On Patents 10 Steps With Pictures

How To Calculate Amortization On Patents 10 Steps With Pictures

Financial Projections Archives Plan Projections

What Is Amortization Definition Formula Examples